StoneCo. is one of the fastest growing company in the financial technology space in Brazil. They provides payment processing solutions and other financial services to merchants with a strong focus in the micro-merchants and small and medium-sized business. Think Square, but dominant in Brazil instead of broader global presence.

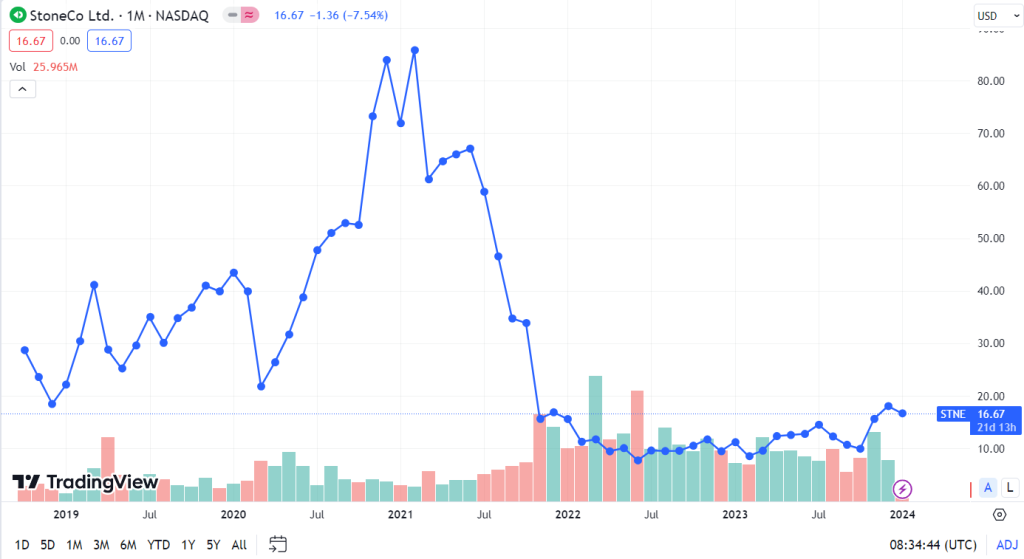

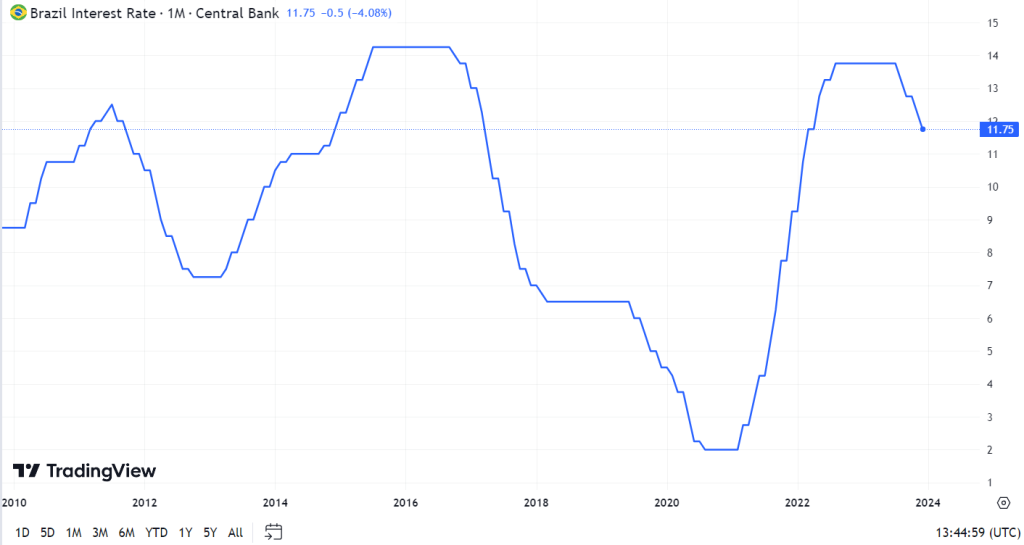

Since its IPO, StoneCo delivered substantial returns, peaking at $80+ in February 2021, fueled by the surging trend of cashless payments. However, paradise was lost when the Brazilian Central Bank’s interest rate hikes crippled StoneCo’s lending business with credit losses. Consequently, their value plummeted to single digits in 2022.

What is so interesting about StoneCo. then?

Firstly, it holds the attention of both Warren Buffett and Cathie Wood – not a guarantee, but certainly noteworthy. Secondly, based on Q3 2023 data, their total revenue soared 25.2% year-over-year, primarily driven by a 41.7% growth in MSMB payment clients, despite the challenging macro environment.

As such, the key question we will try to address today is the potential of StoneCo. While there are various investment elements to consider such as technical analysis, fundamental analysis, and its intrinsic value, we will not be looking into that (in detail) and the real focus is to understand more on the narrative and potential of Stone Co from a macro standpoint.

Brazil’s Booming Digital Payment Landscape

There is a strong potential in digital payment adoption in Brazil. Just 6 years ago (2018), cash account for 52% of POS transaction in Brazil and this had dropped down to 26% in 2022 thanks to Brazil push for financial inclusion with the introduction of Pix, an instant payment system enabling lightning-fast transfers.

This digital push benefits fintech companies like StoneCo tremendously.

Pix a potential threat to StoneCo.

While Pix fuels digital adoption, it poses a potential threat. With a strong use case by individuals to transfer cash from one another, Pix has gradually eaten into debit card usage, saving merchants fees for card machines. This could impact StoneCo’s POS system adoption. Additionally, Pix’s capture of the debit card market, coupled with heightened competition, presents challenges.

StoneCo poised to benefit from interest rate cut

StoneCo’s lending business, once significant, suffered during the interest rate hikes back in 2021. High funding costs disrupted their prepayment operations. Additionally, relying on flawed credit data from Brazil’s registry database to underwrite loans led to loans extended to unworthy businesses, resulting in recognized losses. This has severely impacted their business and likewise its stock performance.

Since then, StoneCo has taken steps to improve its underwriting process and reevaluate its business model. This is to better position themselves strategically in the business segment.

While interest rate hike has posed adverse impact to StoneCo., the elevated interest rate environment has likely peaked. This would hugely benefit StoneCo as Brazilian Central Bank starts cutting interest driving strong economic growth from their client base, and lower funding cost in their credit segment.

The Brazilian digital landscape offers significant opportunities. While StoneCo stands to benefit from macroeconomic tailwinds, intensifying competition within the Brazilian fintech market should not be overlook.