Last week, Fed Chair Powell holds interest rate unchanged but caution that Fed are prepared to tighten policy further (if needed) to bring inflation down sustainably to 2% over time. Having said that, rate hike may potentially be done with a strong case for rate cut in 2024.

To better appreciate this, it is key to look at where we are in the economy and upcoming key developments as that would be the key driver for Fed policy.

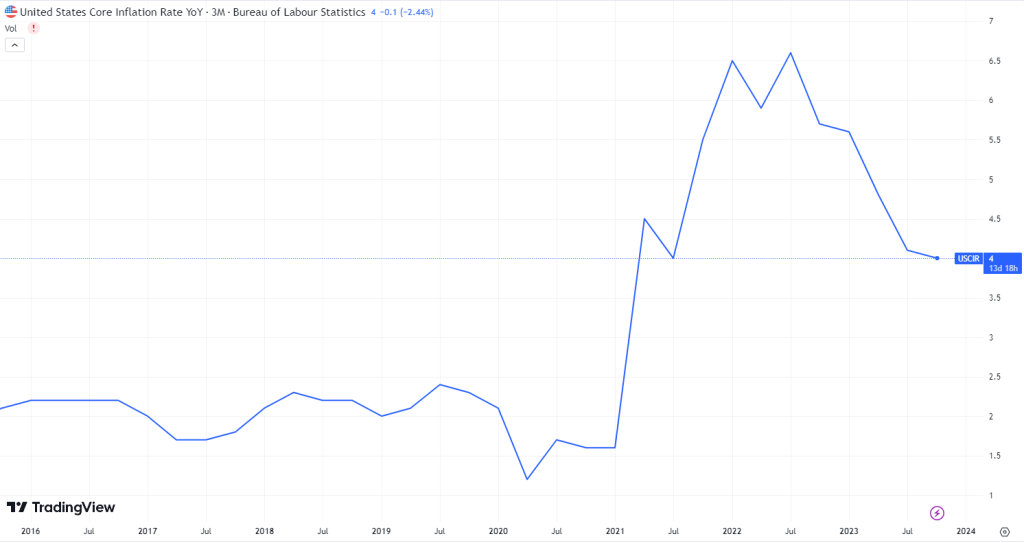

Chart 1: Core Inflation rate slows in November but still short of 2% target range

Inflation rate continue to slow in November moving closer to Fed target range of 2%. While inflation rate target is one of the goal, Fed would need to find the right balance between over tightening that will result in economic slowdown and increased unemployment.

Chart 2: ISM suggest that growth of economic activity has slowed

Which bring us to the second chart here. While GDP (lagging indicator) recorded a positive growth overall, survey released by ISM suggest that economic outlook has slowed (Note: Reading below 50 suggest overall pessimism).

Coupled with data suggesting in economic slowdown and inflation growth slowing down better than expected, Fed has maintained interest rate at the current range.

Chart 3: Majority of FOMC participants see rate falling below 5% in 2024

Despite maintaining rate at current range, FOMC participant view that the target fed fund rates to fall below the 5% range in 2024. This has spark an overall optimistic view amongst investor for 2024 with a potential implied rate cut incoming (at the very least suggesting that rate hike is over).

Favourable Case for rate cuts in 2024 but a cautious pace

Looking at the economic backdrop coupled with scenario below, there is a strong likelihood for a rate cut in 2024:

- Rate hike will pose a continued risk on bank asset which are already underwater with the ongoing hike over the past few quarters. Fed would probably do not want to risk that especially in the coming election year.

- 2024 is an election year and historically, a strong economy has been an advantage for incumbents. As such, there is a huge likelihood that cut will be expected way before the election bearing that you do need a few months before the lower interest rates to have a positive income on consumer spending.

However, I do not view a drastic cut incoming as anticipated by analysts as inflation goes up and down historically. With the ongoing geopolitical situation and various catalyst such as Middle East crisis, and increase in oil price, this would easily drive up inflation. As such, my view is that there is a favourable case for a cut but at a cautious pace.